Mortgage Rates Drop to Lowest Level in over a Year and a Half

Mortgage rates drop and have hit their lowest point in over a year and a half. And that’s big news if you’ve been sitting on the homebuying sidelines waiting for this moment.

Even a small decline in rates could help you get a better monthly payment than you would expect on your next home. And the drop that’s happened recently isn’t small. As Sam Khater, Chief Economist at Freddie Mac, says:

“Mortgage rates have fallen more than half a percent . . . and are at their lowest level since February 2023.”

But if you want to see it to really believe it, here’s how the math shakes out. Take a closer look at the impact on your monthly payment.

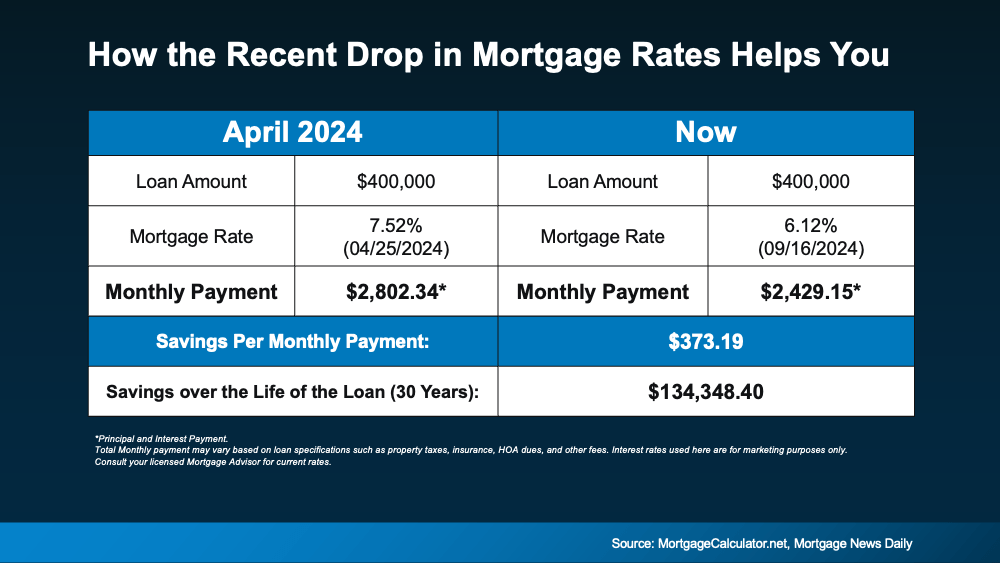

The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house back in April (this year’s mortgage rate high), versus what it could look like if you buy a home now (see below):

Going from 7.5% just a few months ago to the low 6s has a big impact on your bottom line. In just a few months’ time, the anticipated monthly payment on a $400K loan has come down by over $370. That’s hundreds of dollars less per month.

Going from 7.5% just a few months ago to the low 6s has a big impact on your bottom line. In just a few months’ time, the anticipated monthly payment on a $400K loan has come down by over $370. That’s hundreds of dollars less per month.

Bottom Line

With the recent drop in mortgage rates, the purchasing power you have right now is better than it’s been in almost two years. Let’s talk about your options and how you can make the most of this moment you’ve been waiting for.

Leave a Reply